On April 4, the Biden Administration announced the most significant revisions to the Uniform Guidance for Federal Financial Assistance (Section 2 C.F.R.200) since passage of the legislation 10 years ago. The primary goals of the revisions are to streamline compliance requirements, remove overly burdensome aspects of the application and grants administration process, clarify vague and too complex language, and improve access to funding for underrepresented communities and groups including tribal nations.

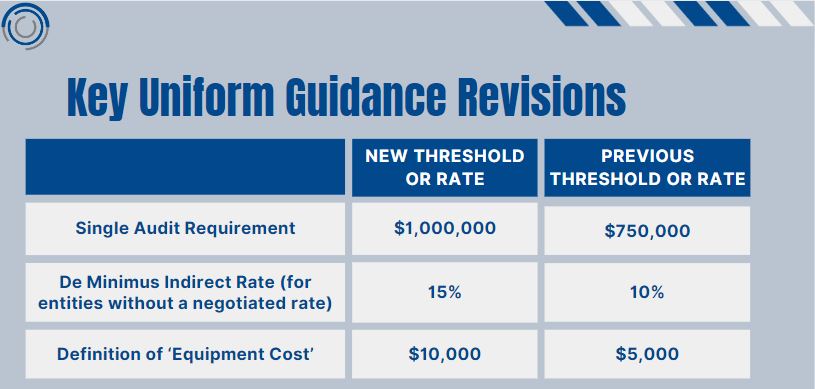

The federal government annually disburses $1.2 trillion across a range of individuals and organizations for programs in social and community development, education, research and other related areas. The impact of these revisions promises to be significant for organizations receiving federal funding. Some of the key revisions are below.

In addition, written approvals required by several Uniform Guidance cost principles have been eliminated, removing an administrative burden associated with program management. Further, Notices of Funding Opportunities have been simplified in consideration of groups with less experience applying for federal funds.

Federal agencies must implement revisions to their Uniform Guidance procedures no later than October 1, 2024, though they have the option of adopting the revisions to awards issued prior to then.

The April 4 announcement reflects pre-publication revisions to Uniform Guidance not yet codified in the Federal Register. It is possible that additional technical updates may be proposed and appear in the final, published version. However, Councilor, Buchanan & Mitchell’s (CBM) team recommends that finance directors, grants managers and others responsible for oversight of federally funded programs do not hesitate to consider the impact of these changes on their organizations by:

- Reviewing the impact of new requirements on grants administration and programming and making necessary updates at their organizations.

- Identifying adjustments that need to be made to compliance requirements.

- Updating their organizations’ policies and procedures to align with the requirements.

- Informing and training applicable staff about the new requirements.

- Communicating with other stakeholders including federal agencies, state and local governments, other pass-through sponsors, award subrecipients and auditors.

Current revisions to Uniform Guidance reflect a landscape in which the federal government attempts to balance stewardship of taxpayer assets with pursuit of the best way to serve communities without overly burdening grant awardees or restricting access to deserving organizations. CBM believes that not-for-profit organizations benefiting from these programs should stay current with ongoing updates to the legislation.

Our professionals conduct Single Audits for not-for-profits and provide outsourced accounting management and audit preparation expertise for groups working with other audit firms. Our team has a strong understanding of Uniform Guidance Compliance requirements.

Please reach out to us with any questions. Contact Holly Caporale, a director of CBM’s not-for-profit services group via our online contact form.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.