The article below appears in a longer, more detailed white paper with exclusive content focused on building a strong financial foundation for early career professionals. Click here to access the white paper.

It’s never too early for young professionals to start planning for a sound financial future. By following these important financial considerations, you have already taken the first step.

Know Your Worth

First, do you understand what your net worth is?

Net worth is your ASSETS minus your LIABILITIES. Your assets include your bank account, investments, retirement account, owned property, etc. Don’t forget about your most important asset: YOURSELF! (See Part II – for protecting your asset). Your liabilities are what you owe, such as student debt, credit card balances, car loans, mortgage, etc.

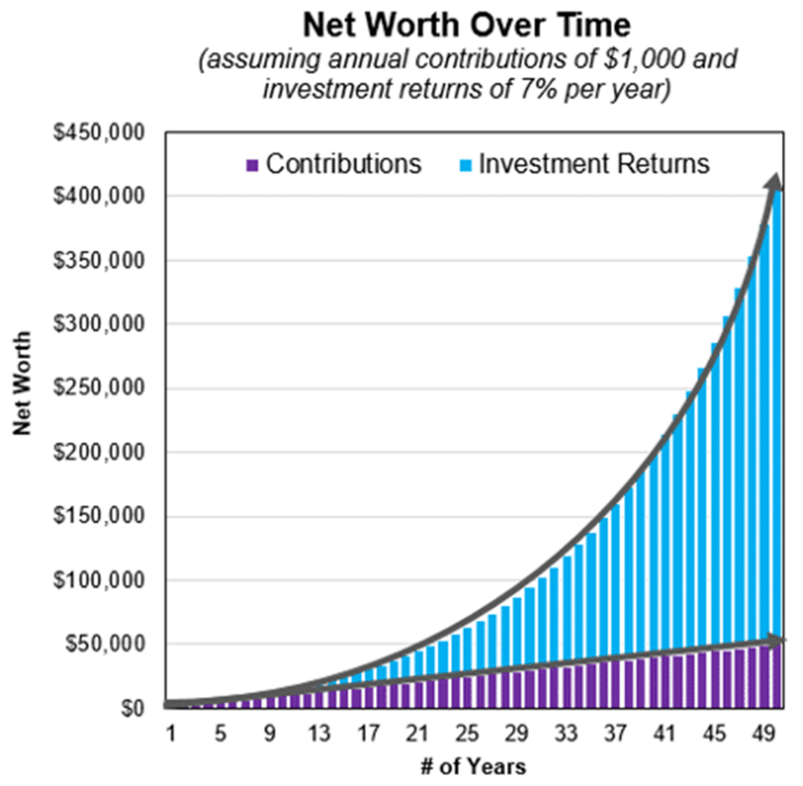

Simply put, the two ways to grow your net worth are to increase your assets or decrease your liabilities, or – both! To understand what strategies are available to you, first consider tracking your net worth over time so you can see the relationship between the changes in your assets and liabilities, and how they affect your net worth. That way, you can use this information to adjust where needed to achieve your financial goals.

Understand Your Goals

Having a general plan of attack for growing your net worth is one effective way in keeping organized and making progress. Keep in mind, these steps can and do overlap, but this is a great guideline to use, especially if you’re not sure where to start:

- Create a budget, reduce expenses, and set realistic financial goals. Self-reflection is key to understand your habits, your relationship with money, what motivates you, etc. so that you can set achievable goals.

- Build a liquid emergency fund to cover around 3 to 6 months of your expenses.

- Take full advantage of employer-sponsored matching funds (i.e., for a retirement account).

- Pay down moderate and high interest debts.

- Build savings for retirement in an IRA and for higher education expenses.

- Save for other goals and other advanced methods.

Key cornerstones to success:

- Live within your means, or said another way, don’t spend it if you don’t have it – or if you need to spend it, have a plan in place to pay down the debt

- Spend wisely

- Buying does not necessarily mean affording

- When evaluating your budget to trim expenses, search for value, i.e, look at your largest expense first and see how you can trim

Save and Invest

After you have saved the 3-to-6-months of emergency funds mentioned earlier, think about working to maximize your 401K/403b contributions and traditional or Roth IRA contributions. Then consider investing in brokerage accounts. If you can’t maximize your 401K contributions initially, that’s okay. Start where you can and increase your contribution by a percentage or dollar amount each year.

Some investment options include mutual funds, exchange traded funds, individual stocks and bonds, private equities, real estate, and physical assets. The most important thing to do is reduce your risk by diversifying and balancing your portfolio—don’t put all your eggs in one basket. Investing in three to five funds is generally enough to start out and be diversified. And if you are looking for more advice on investing, CBM offers a great quarterly market investment update.

Some final considerations for saving and investing include knowing your short, medium, and long-term goals, recognizing that liquidity versus risk is an inverse relationship, understanding that cash is king for emergencies, and being aware of different fee structures for advisors and planners to ensure they are operating in your best interest.

Contact Reema Patel with any questions via our online contact form.

Other Resources

- Smart Financial Planning II: Managing Debt, Protecting Your Loved Ones and Tax Planning

- White Paper: Financial Planning for Early Career Stage Professionals

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.