Quick References are high-level insights about critical issues and concerns facing your organization. Our outsourced accounting and advisory group is available to help you implement solutions. Click here to view other Quick References and to sign up for email alerts when future Quick References are released.

**Update: The DOL overtime rule has been struck down by a federal court as of 11/15/2024**

The U.S. Department of Labor has issued a final rule increasing the minimum salary required for certain type of employees to be considered exempt from the Fair Labor Standards Act (FLSA) overtime pay requirements.

Summary of Updates

- Effective July 1, 2024, the salary threshold for overtime exemption will increase to an annual salary of $43,888 or $844/week (from $35,568 set in 2019) for bona fide executive, administrative, and professional employees as provided in the DOL’s regulations for the “duties test.”

- An additional adjustment will be made on January 1, 2025 to increase the overtime exemption to an annual salary of $58,656 or $1,128/week for these employees.

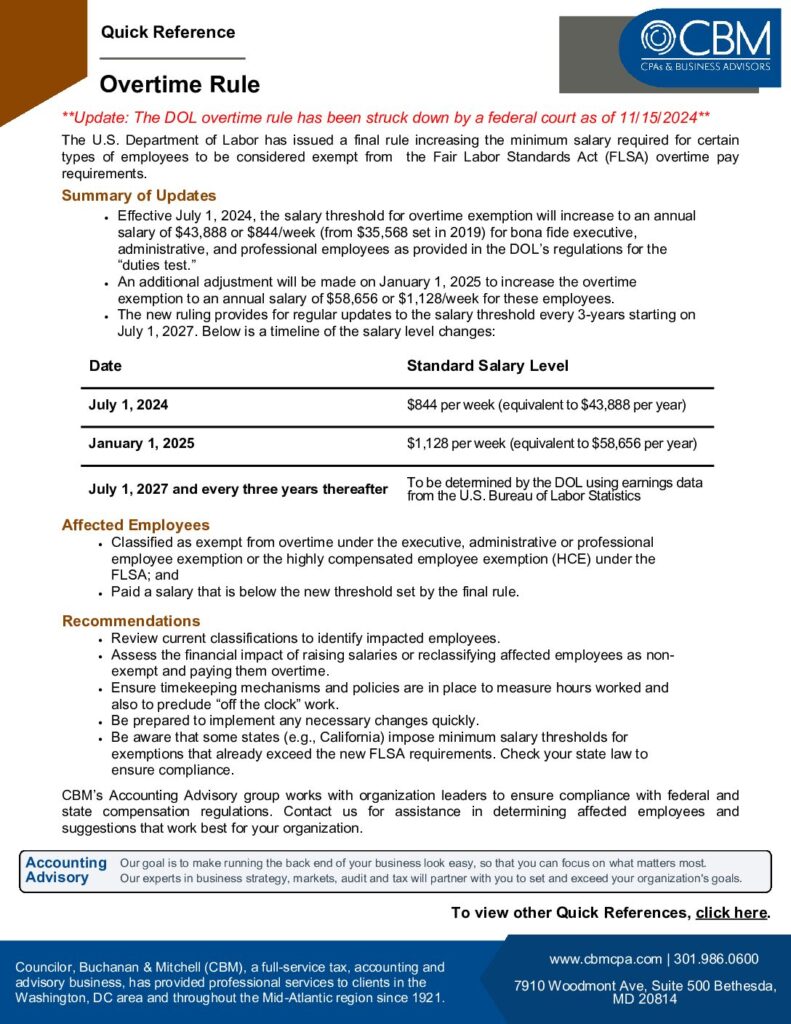

- The new ruling provides for regular updates to the salary threshold every 3-years starting on July 1, 2027. Below is a timeline of the salary level changes:

| Date | Standard Salary Level |

| July 1, 2024 | $844 per week (equivalent to $43,888 per year) |

| January 1, 2025 | $1,128 per week (equivalent to $58,656 per year) |

| July 1, 2027 and every three years thereafter | To be determined by the DOL using earnings data from the U.S. Bureau of Labor Statistics |

Affected Employees

- Classified as exempt from overtime under the executive, administrative or professional employee exemption or the highly compensated employee exemption (HCE) under the FLSA; and

- Paid a salary that is below the new threshold set by the final rule.

Recommendations

- Review current classifications to identify impacted employees.

- Assess the financial impact of raising salaries or reclassifying affected employees as non-exempt and paying them overtime.

- Ensure timekeeping mechanisms and policies are in place to measure hours worked and also to preclude “off the clock” work.

- Be prepared to implement any necessary changes quickly.

- Be aware that some states (e.g., California) impose minimum salary thresholds for exemptions that already exceed the new FLSA requirements. Check your state law to ensure compliance.

CBM’s Accounting Advisory group works with organization leaders to ensure compliance with federal and state compensation regulations. Contact us for assistance in determining affected employees and suggestions that work best for your organization.

CBM’s outsourced accounting and advisory group: Our goal is to make running the back end of your business look easy, so that you can focus on what matters most. Our experts in business strategy, markets, audit and tax will partner with you to set and exceed your organization’s goals.

Please contact Dominick V. Bellia via our online contact form for more information.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.