It’s never too early to start gathering the necessary information required to prepare and file 1099s for your business.

Reminders:

- Businesses and not-for-profits must issue 1099 forms to anyone other than a corporation, with some exceptions, who were paid $600 or more in non-employment income during the year.

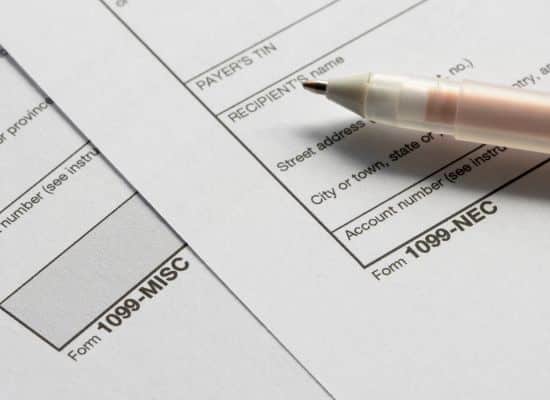

- There are many types of 1099 forms listed on the IRS website, but the most common for organizations are:

o 1099-NEC Non-Employee Compensation due January 31 (hint: payments to independent contractors or freelancers)

o 1099-MISC Miscellaneous Income due February 28 (hint: payments to the organization’s attorney or rent payments)

Best Practices About Form 1099 from CBM’s Accounting Advisory Team

For a smooth and timely 1099 filing season, consider the following best practices:

- Collect W-9 Forms Throughout the Year – W-9s provide all the information necessary to file 1099s, and collecting it throughout the calendar year ensures you have vendor information on hand when it’s time to file so you can avoid penalties for late issuance.

- Collect W-9 Forms Before Paying Vendors – It is best practice to collect a completed W-9 form before paying a new vendor so you have it on file when needed. Vendors are more responsive to W-9 requests before they’ve been paid.

- Review Your List of Vendors for Accuracy and Completeness – Before approaching the end of the year, review your list of payees and vendors to ensure you have accurate or updated W-9 forms on file.

Need assistance? CBM’s Accounting Advisory team supports businesses with accounting and tax preparation expertise. Use our online contact form to contact now to contact Dominick Bellia for guidance or for assistance.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.