Quick References are high-level insights about critical issues and concerns facing your organization. Our outsourced accounting and advisory group is available to help you implement solutions. Click here to view other Quick References and to sign up for email alerts when future Quick References are released.

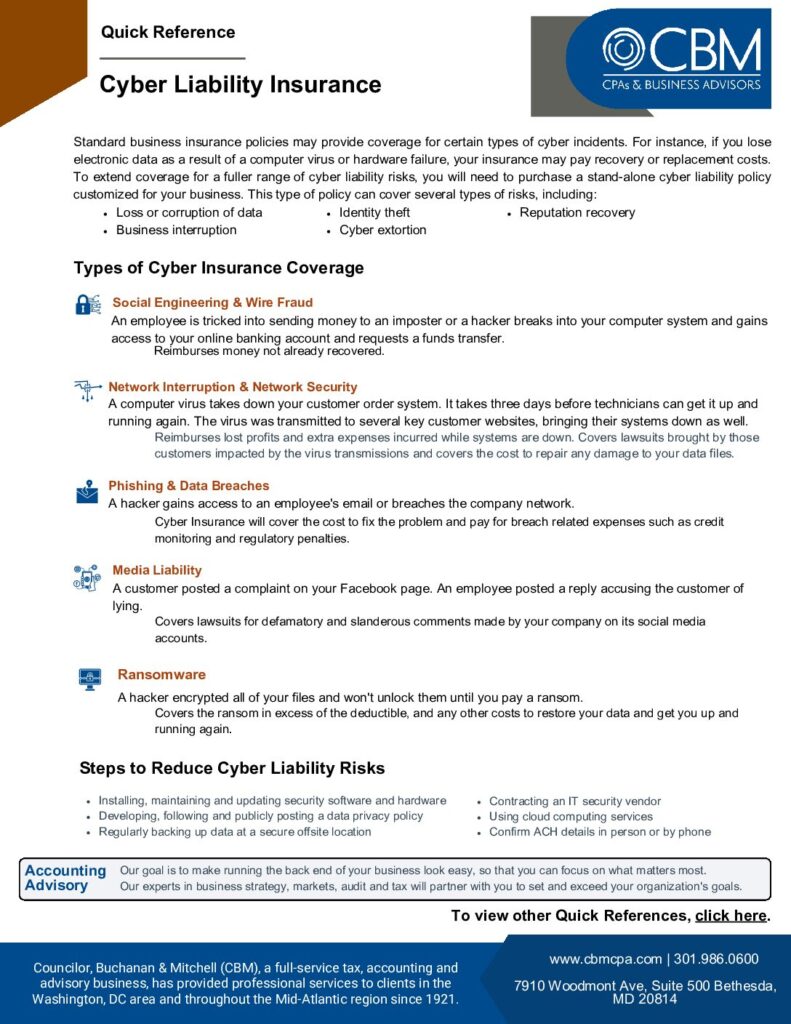

Standard business insurance policies may provide coverage for certain types of cyber incidents. For instance, if you lose electronic data as a result of a computer virus or hardware failure, your insurance may pay recovery or replacement costs. To extend coverage for a fuller range of cyber liability risks, you will need to purchase a stand-alone cyber liability policy customized for your business. This type of policy can cover several types of risks, including:

- Loss or corruption of data

- Business interrruption

- Identity theft

- Cyber extortion

- Reputation recovery

Types of Cyber Insurance Coverage

- Social Engineering and Wire Fraud – An employee is tricked into sending money to an imposter, or a hacker breaks into your computer system and gains access to your online banking account and requests a funds transfer. Cyber insurance can help with reimbursing money not already recovered.

- Network Interruption & Network Security – A computer virus takes down your computer order system. It takes three days before technicians can get it up and running again. The virus was transmitted to several key customer websites, bringing their systems down as well. Cyber insurance can help reimburse for lost profits and extra expenses incurred while systems are down. Insurance also covers lawsuits brought by those customers impacted by the virus transmissions and covers the cost to repair any damage to your data files.

- Phishing & Data Breaches – A hacker gains access to an employee’s email or breaches the company’s network. Cyber insurance will cover the cost to fix the problem and pay for breach-related expenses such as credit monitoring and regulatory penalties.

- Media Liability – A customer posted a complaint on your Facebook page. An employee posted a reply accusing the customer of lying. Cyber insurance covers lawsuits for defamatory and slanderous comments made by your company on its social media accounts.

- Ransomware – A hacker encrypted all of your files and won’t unlock them until you pay a ransom. Cyber liability insurance covers the ransom in excess of the deductible, and any other costs to restore your data and get you up and running again.

Steps to Reduce Cyber Liability Risks

CBM’s Accounting Advisory group recommends the following steps to reduce cyber liability risks.

- Install, maintain and update security software and hardware

- Develop, follow and publicly post a data privacy policy

- Regularly back up data at a secure offsite location

- Contract an IT security vendor

- Use cloud computing services

- Confirm ACH details in person or by phone

CBM’s Accounting Advisory group: Our goal is to make running the back end of your business look easy, so that you can focus on what matters most. Our experts in business strategy, markets, audit and tax will partner with you to set and exceed your organization’s goals.

Please contact Dominick V. Bellia via our online contact form for more information.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.