For years, people have questioned the long-term viability of the Social Security system. While you can’t do much about that, you can start planning how to maximize your Social Security benefits when you’re eligible to claim them.

People approaching retirement age often have questions about benefits they may be eligible to receive from the Social Security Administration (SSA). Here are eight of the most commonly asked queries:

1. How Soon Can I Start Collecting Retirement Benefits?

If you want to receive full retirement benefits from the SSA, you must wait until you reach the so-called full retirement age (FRA). But you may apply for benefits as early as age 62. Starting early will reduce your monthly benefits by as much as 30%, but you’ll receive benefits for more years. Your tax advisor can help you determine the exact monthly benefit reduction and assist you in deciding whether you’ll likely be better off waiting until your FRA to start taking benefits.

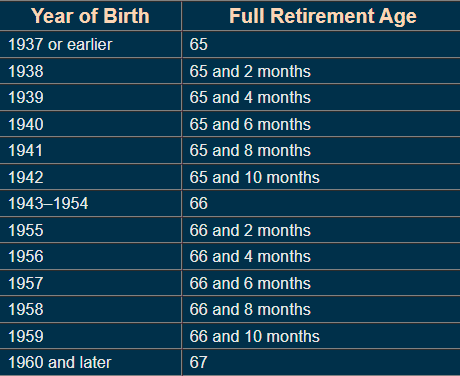

2. What’s My FRA?

Your FRA depends on the year in which you were born.

If you were born on January 1 of any year, refer to the previous year. If you were born on the first of the month, the SSA figures your benefit (and your FRA) as if your birthday were in the previous month.

3. How and When Do I Apply for Social Security Retirement Benefits?

Apply for retirement benefits three months before you want your payments to start. The SSA may request certain documents in order to pay benefits, including:

- Your original birth certificate or other proof of birth,

- A marriage certificate or divorce decree when applying for spousal benefits,

- Proof of U.S. citizenship or lawful alien status if you weren’t born in the United States,

- A copy of your U.S. military service paper(s) if you performed military service before 1968, and

- A copy of your W-2 Form(s) and/or self-employment tax return for the previous year.

- For most retirees, the easiest way to apply for benefits is by using the online application.

4. What Happens if I Receive Social Security Retirement Benefits While Still Working?

If you’re under your FRA and earn more than the annual limit (subject to inflation indexing), your benefits will be reduced, as follows:

- If you’re under FRA for the entire year, you forfeit $1 in benefits for every $2 earned above the annual limit. For 2022, the limit is $19,560, up from $18,960 in 2021.

- In the year in which you reach FRA, you forfeit $1 in benefits for every $3 earned above a separate limit, but only for earnings before the month you reach FRA. The limit in 2022 is $51,960, up from $50,520 in 2021.

Beginning with the month in which you reach FRA, you can receive your benefits without regard to your earnings.

5. Can I Collect More Benefits if I Retire After My FRA?

You can receive increased monthly benefits by applying for Social Security after reaching FRA. The benefits may increase by as much as 32% if you wait until age 70, but of course you’ll receive benefits for fewer years. After age 70, there is no further increase. Your tax advisor can help calculate the payout for waiting to collect your retirement benefits and help you determine whether you’ll likely be better off waiting beyond your FRA to start taking benefits.

6. Can I Manage Retirement Benefits for an Incapacitated Person?

If a Social Security recipient needs help managing his or her retirement benefits — perhaps an elderly parent — contact your local Social Security office. You must apply to become that person’s representative payee in order to assume responsibility for using the funds for the recipient’s benefit.

7. Do I Qualify for Social Security Survivors Benefits?

A spouse and children of a deceased person may be eligible for benefits based on the deceased’s earnings record as follows:

A widow or widower can receive benefits:

- At age 60 or older,

- At age 50 or older if disabled, or

- At any age if she or he takes care of a child of the deceased who’s younger than age 16 or disabled.

A surviving ex-spouse might also be eligible for benefits under certain circumstances. In addition, unmarried children can receive benefits if they’re:

- Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full-time), or

- Any age and were disabled before age 22 and remain disabled.

Under certain circumstances, benefits also can be paid to stepchildren, grandchildren, step-grandchildren or adopted children. In addition, dependent parents age 62 or older who received at least one-half support from the deceased may be eligible to receive benefits.

A one-time payment of $255 may be made only to a spouse or child if he or she meets certain requirements. Survivors must apply for this payment within two years of the date of death.

8. Are Social Security Benefits Subject to Income Tax?

You’ll be taxed on Social Security benefits if your provisional income (PI) exceeds the thresholds within a two-tier system.

PI between $32,000 and $44,000 ($25,000 and $34,000 for single filers). Recipients in this range are taxed on the lesser of 1) one-half of their benefits or 2) 50% of the amount by which PI exceeds $32,000 ($25,000 for single filers).

PI above $44,000 ($34,000 for single filers). Recipients above this threshold are taxed on 85% of the amount by which PI exceeds $44,000 ($34,000 for single filers) plus the lesser of 1) the amount determined under the first tier or 2) $6,000 ($4,500 for single filers).

PI equals the sum of 1) your adjusted gross income, 2) your tax-exempt interest income, and 3) one-half of the Social Security benefits received.

Please contact Judith Barnhard via our online contact form for more information.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.