Quickbooks from Intuit has been a trusted tool for business owners and accountants alike for many years. With cloud computing ‘s prevalence increasing in today’s business world, Quickbooks Online (QBO) is more popular than ever and Intuit continues to improve the software’s powerful tools. This article looks at some recommended best practices for using QBO so that it continues to help you run your business while minimizing the stress over the financial aspect of it.

1. Accounts and Settings

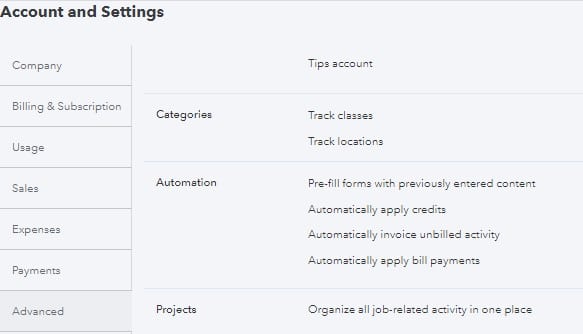

First, it is important to be aware of the settings and features QBO offers that can benefit your company. The Account and Settings options can be found by clicking on the gear icon in the upper right corner of the QBO screen. Once there you can add your company details and set up options for customer invoices, vendor bills, outgoing payments, etc. You’ll also find some time-savings tools available as well. Quickbooks is continually adding and improving features, so it is a good idea to check your settings often to make sure you’re benefiting from all QBO has to offer.

2. Chart of Accounts

QBO provides a default chart of accounts when you set up your company in the program, but it is always a good idea to review that list to make sure they all fit your needs. You can inactivate and add accounts as needed. You can also edit existing account names, for example, instead of using “Cash” you could change it to the actual bank account name and maybe even include the last four digits of the bank account; which can be helpful in keeping track when you have multiple bank accounts. Account numbers are a great way to organize accounts for order and readability, and to organize reports used outside of QuickBooks. When managing your chart of accounts, keep in mind that conciseness is better for reporting purposes. Try to avoid being too specific when creating accounts.

3. Vendor and Customer List Management

It is also important to maintain your vendor and customer lists in QBO. Whenever you record an expense you should assign a payee so that you can keep track of amounts paid to each vendor; this is especially helpful when generating reports for Form 1099 filings. Remember that you can, and should, mark specific vendors as 1099 recipients to make compiling 1099 recipient data much easier. If QBO is the main location for tracking revenues it can also be beneficial to enter the customer name in the ‘Received From’ field when recording incoming receipts and deposits.

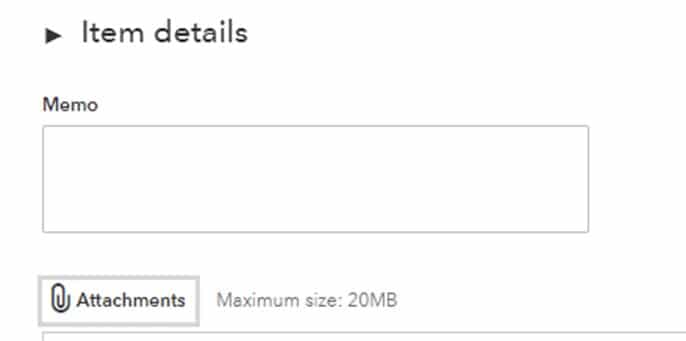

4. Inserting Supporting Documents

QBO also allows you to upload and store supporting documents. You can add bills and receipts as attachments to specific transactions. In an increasingly digital world, this is a great feature that promotes transparency. If you’re not already using a separate cloud-based bill payment solution, be sure to use this feature, as it allows you to store and organize your documentation conveniently without requiring physical space for it.

5. Support

Finally, and perhaps most importantly: don’t be afraid to ask for help! Ask your accountant, advisor or even QB support if you’re not sure about setup, usage of current features, or available options you are not using.

We encourage you to make a habit of exploring and testing product enhancements as new tools are released–some will undoubtedly save you time and effort.

Contact Us for Support with Using QuickBooks for Your Business:

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.