Tax reform increased first-year bonus depreciation to 100% for most long-term assets placed in service after September 27, 2018. When using bonus depreciation, eligible assets are not subject to an annual dollar limit; except for listed property, the asset does not need to be used 50% of the time for business; and they are not limited to annual business profit. The generous depreciation percentage remains in effect from September 27, 2017, until January 1, 2023, after which it is scheduled to go through an eventual phaseout. The write-off potential in this category is significant.

Businesses with floor plan financing indebtedness were initially presumed to be excluded from 100% bonus depreciation (full expensing).

The new proposed bonus depreciation regulations gave automobile, heavy truck, and heavy machinery dealers most of the flexibility they wanted regarding floor plan financing interest, leaving only one issue for further clarification.

2019 Changes to Depreciation – Proposed Regulations on Bonus Depreciation

- 100% bonus depreciation still allowed for assets place in service in 2019

- Proposed regulations issued on September 13, 2019 address dealers’ eligibility for bonus depreciation

- Confirmed real estate entities leasing to dealerships are eligible to utilize bonus depreciation

- These regulations clarity that if all business interest expense, including floor plan financing interest, does not exceed the 30% ATI limitation, then bonus depreciation is allowed

- Annual determination to elect bonus depreciation

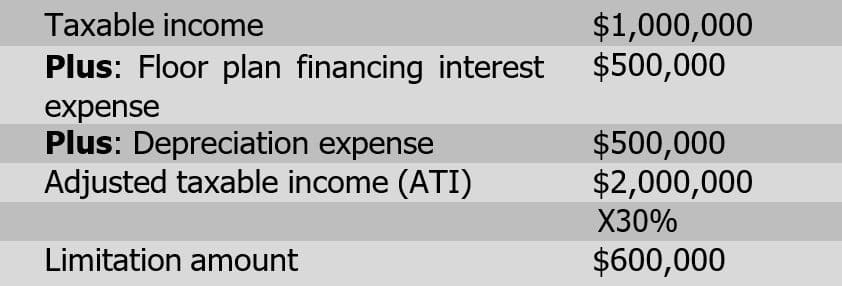

Section 163(J) Example – Bonus Allowed

• Gross receipts – $30,000,000

• Taxable income – $1,000,000

• Depreciation expense – $500,000

• Floor plan financing interest expense (gross) – $500,000

• Business interest expense ($500,000) < 30% ATI threshold ($600,000); therefore, bonus depreciation is allowed

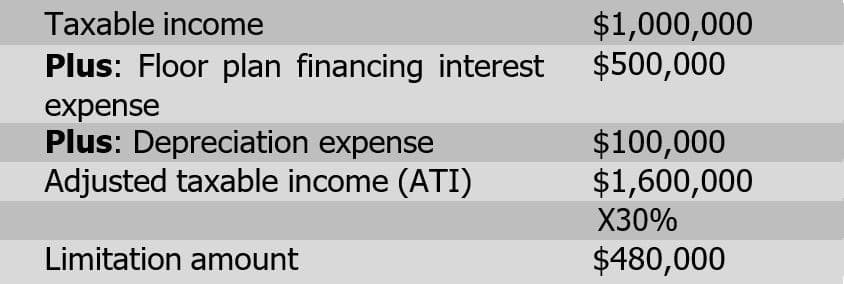

Section 163(J) Example – Bonus Disallowed

• Gross receipts – $30,000,000

• Taxable income – $1,000,000

• Depreciation expense – $100,000

• Floor plan financing interest expense (gross) – $500,000

• Business interest expense ($500,000) > 30% ATI threshold ($480,000); therefore, bonus depreciation is disallowed

The dealers didn’t appear to get their sought-after clarification that a taxpayer could decline the Section 163(j) exception for floor plan financing interest and elect to retain full bonus depreciation even it the exception would otherwise apply.

We expect that the government will receive comments requesting further clarification of the electability issue.

For more information about bonus depreciation and your dealership, please reach out to John Comunale or Keith Laudenberger via our online contact form.

Councilor, Buchanan & Mitchell (CBM) is a professional services firm delivering tax, accounting and business advisory expertise throughout the Mid-Atlantic region from offices in Bethesda, MD and Washington, DC.